Homeowners Insurance in and around Branson West

Homeowners of Branson West, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Billings

- Blue Eye

- Branson

- Branson West

- Cape Fair

- Clever

- Crane

- Forsyth

- Galena

- Highlandville

- Hollister

- Kimberling City

- Lampe

- Marionville

- Nixa

- Ozark

- Rockaway Beach

- Saddlebrooke

- Shell Knob

- Sparta

Home Is Where Your Heart Is

Everyone knows having great home insurance is essential in case of a tornado, fire or blizzard. But homeowners insurance is about more than covering natural disaster damage. One important part of home insurance is that it also covers you in certain legal cases. If someone falls in your home, you could be required to pay for physical therapy or their lost wages. With adequate home coverage, your insurance may cover those costs.

Homeowners of Branson West, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Why Homeowners In Branson West Choose State Farm

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Maureen Darby can be there whenever you have problems at home, to get your homelife back to normal. State Farm is there for you.

Let us help with the details of insuring your home with State Farm's outstanding homeowners insurance. All you need to do to lay the foundation is visit Maureen Darby today!

Have More Questions About Homeowners Insurance?

Call Maureen at (417) 272-3333 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Boost your home pool safety

Boost your home pool safety

Safety reminders and guidelines to make sure your swimming pool or hot tub is ready for the season.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

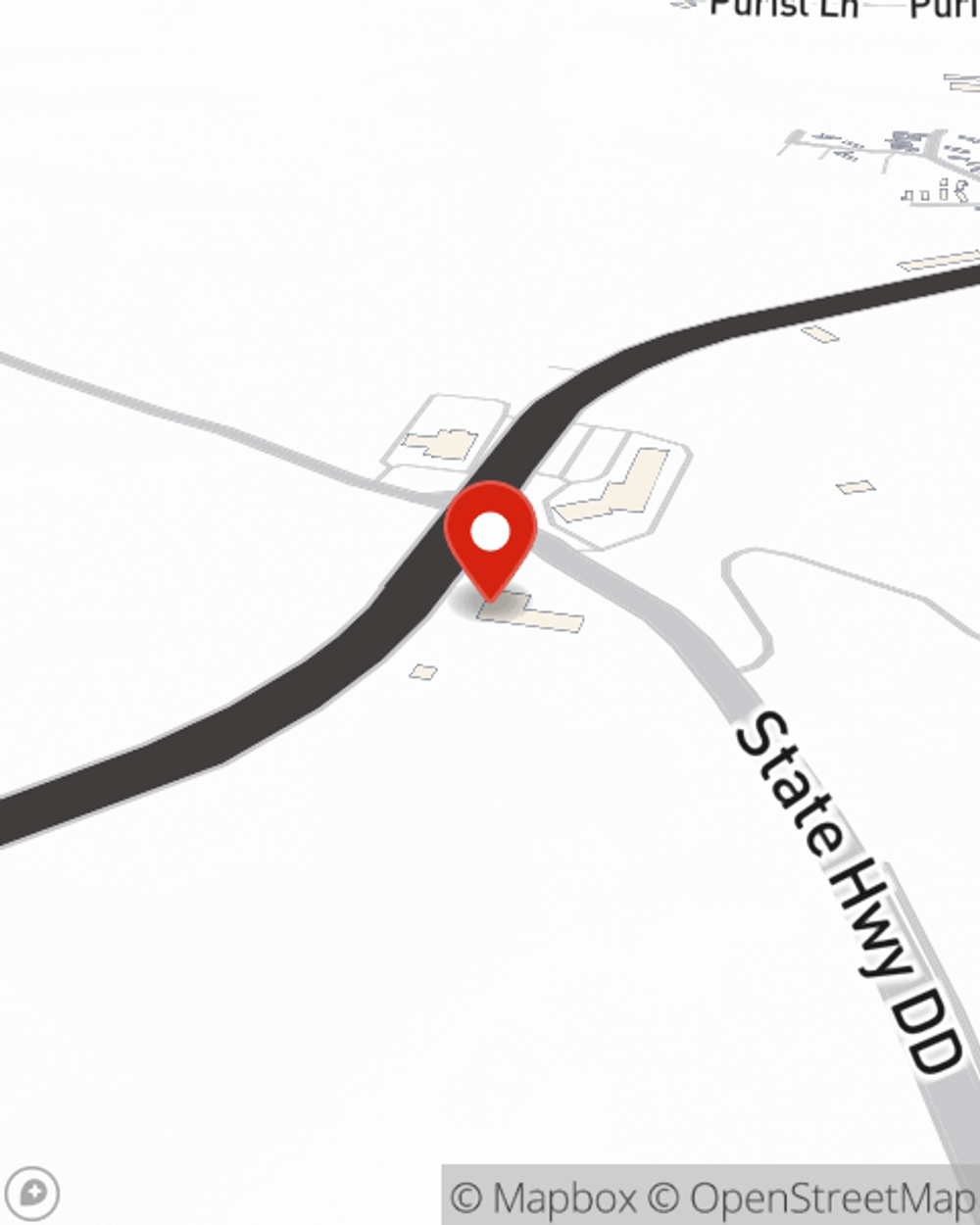

Maureen Darby

State Farm® Insurance AgentSimple Insights®

Boost your home pool safety

Boost your home pool safety

Safety reminders and guidelines to make sure your swimming pool or hot tub is ready for the season.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.